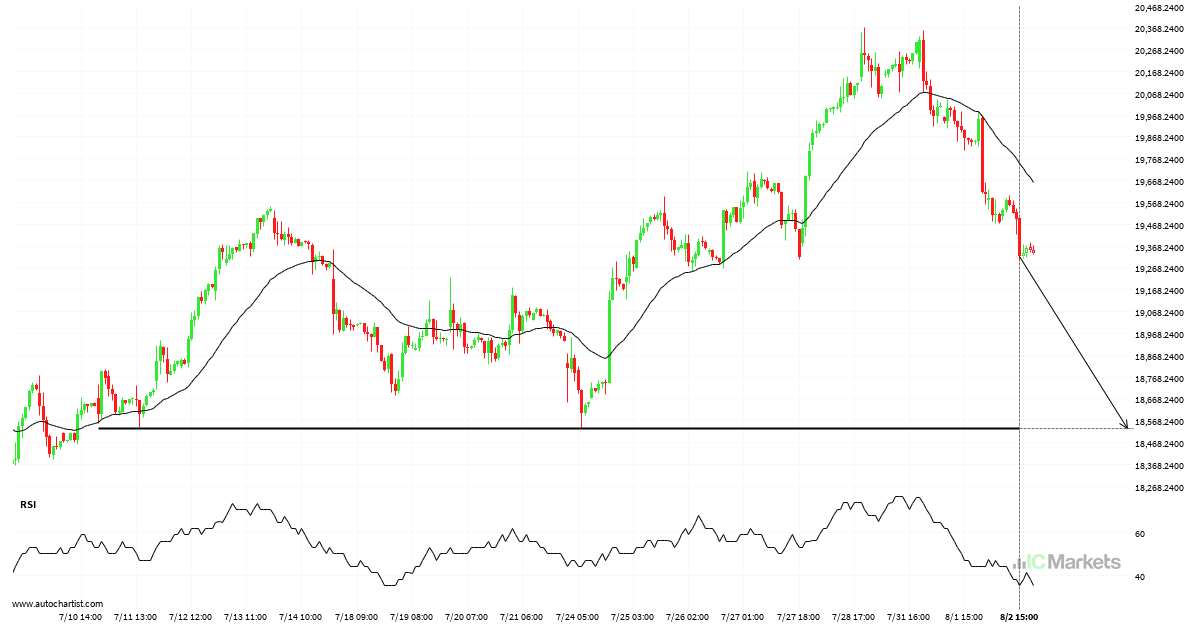

Hong Kong 50 Index – getting close to psychological price line

Hong Kong 50 Index is moving towards a support line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 23 days and may test it again […]

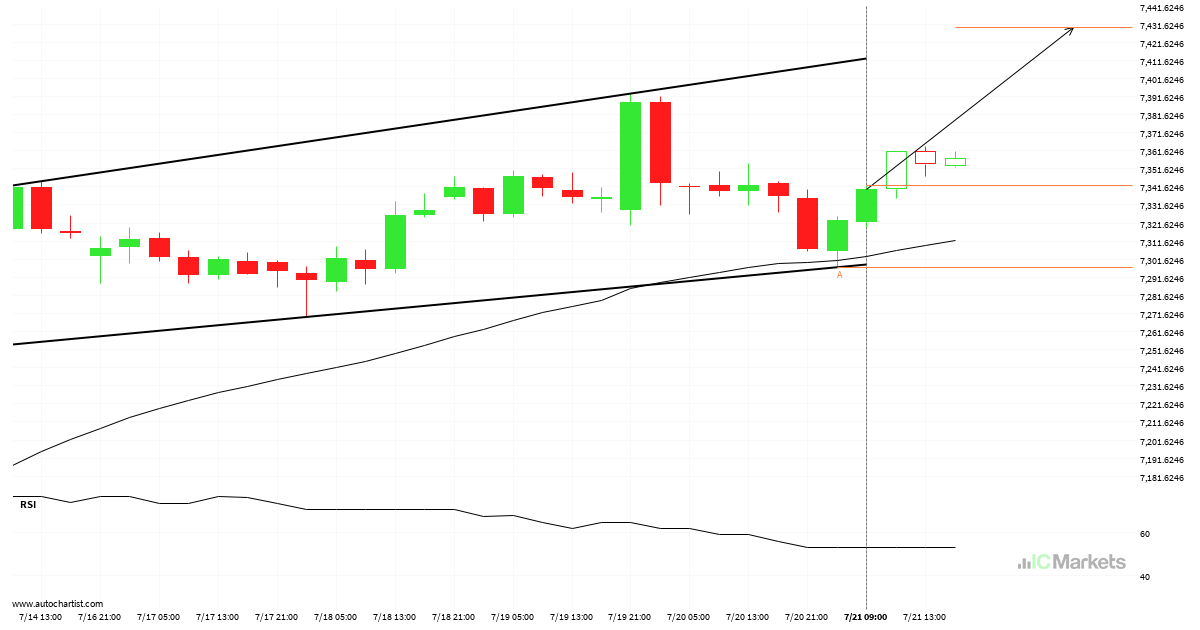

Australia 200 Index approaching resistance of a Channel Up

Australia 200 Index is approaching the resistance line of a Channel Up. It has touched this line numerous times in the last 15 days. If it tests this line again, it should do so in the next 3 days.

FTSE China A50 Index – getting close to psychological price line

FTSE China A50 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 4 days and may test it again […]

Australia 200 Index – getting close to psychological price line

Australia 200 Index is moving towards a support line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 14 days and may test it again within […]

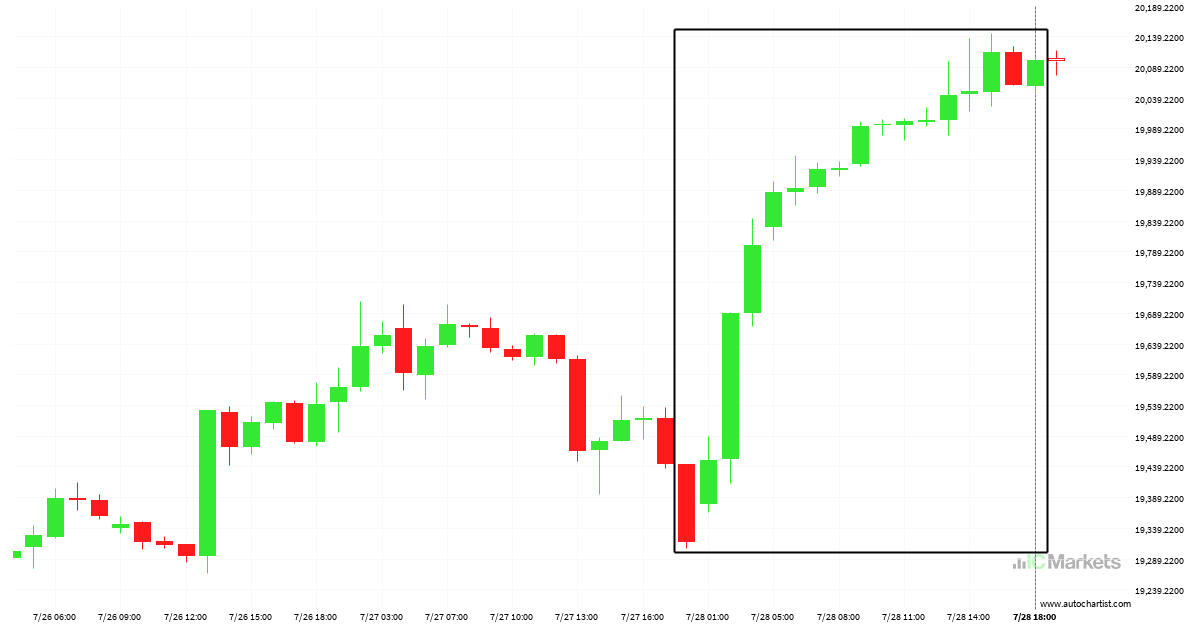

Huge bullish move on Hong Kong 50 Index

Hong Kong 50 Index has moved higher by 4.04% from 19319.2 to 20100.2 in the last 2 days.

Hong Kong 50 Index has broken through resistance

Hong Kong 50 Index has broken through a resistance line. It has touched this line at least twice in the last 18 days. This breakout may indicate a potential move to 19598.7910 within the next 22 hours. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

FTSE China A50 Index broke through important 12619.0000 price line

FTSE China A50 Index has broken through a resistance line. It has touched this line numerous times in the last 13 days. This breakout shows a potential move to 12766.1221 within the next 2 days. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

Hong Kong 50 Index has broken through support

Hong Kong 50 Index has broken through a support line. It has touched this line at least twice in the last 21 days. This breakout may indicate a potential move to 18334.4733 within the next 3 days. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

Australia 200 Index approaching resistance of a Flag

Australia 200 Index is approaching the resistance line of a Flag. It has touched this line numerous times in the last 12 days. If it tests this line again, it should do so in the next 21 hours.

Hong Kong 50 Index approaching resistance of a Ascending Triangle

Hong Kong 50 Index is approaching the resistance line of a Ascending Triangle. It has touched this line numerous times in the last 21 days. If it tests this line again, it should do so in the next 3 days.